Routing Number

What is the routing number?The routing number (a.k.a. routing transit number) is a 9-digit number that serves to identify the specific financial institution responsible for the payment of a negotiable instrument. |

||||||||||||||||||||||||||||||||||||||||||||||||||||

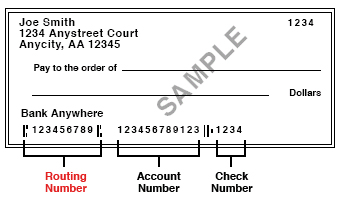

Where is the routing number on my check?The sample graphic below shows where the routing number can be found in the bottom left corner of your checks.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||

Routing number formatThe routing number consists of 9 digits:The ABA Routing Number is of the form XXXXYYYYC

Federal Reserve Routing NumberThe Federal Reserve Routing Numbers were originally assigned in the systematic way outlined below, reflecting a bank's geographical location and internal handling by the Federal Reserve. However, the link is today tenuous - following banking consolidation, many banks use a routing number from a now-defunct bank, while the Federal Reserve no longer assigns specific numbers for thrifts, nor does the "check processing facility" have any current meaning, as check processing is now centralized within each Federal Reserve district. First two digitsThe first two digits of the nine digit ABA number must be in the ranges 00 through 12, 21 through 32, 61 through 72, or 80. The digits are assigned as follows:

The first two digits correspond to the 12 Federal Reserve Banks as follows:

Third and fourth digitsThe third digit corresponds to the Federal Reserve check processing center originally assigned to the bank, while the fourth digit is "0" if the bank is located in the Federal Reserve city proper, and otherwise is 1-9, according to which state in the Federal Reserve district it is. Check digitThe check digit provides a checksum test using a position-weighted sum of each of the digits. High-speed check-sorting equipment will typically verify the checksum, and route the item to a reject pocket for manual examination, repair, and re-sorting. Mis-routings to an incorrect bank are thus greatly reduced. Read more about the Routing number at Wikipedia website. |

What is FedACH?FedACH is the Federal Reserve Banks' Automated Clearing House for financial institutions. The FedACH offers financial institutions, corporations, and consumers an efficient alternative payment method to writing, collecting, and processing paper checks. |

What is the Routing number?A routing number is a nine-digit numeric code printed on the bottom of checks that is used to facilitate the electronic routing of funds (ACH transfer) from one bank account to another. It's also referred to as RTN, routing transit number or bank routing number.Read more |

What are the Fedwire Funds Service and the Fedwire Securities Service?The Fedwire Funds Service is the real-time gross settlement electronic payments service owned and operated by the Federal Reserve Banks. The Fedwire Securities Service is a real-time gross settlement book-entry securities service owned and operated by the Federal Reserve Banks that allows for the immediate, simultaneous delivery of securities against payment. Fedwire participants are primarily depository institutions acting on behalf of themselves and their customers. |